GLOBAL Equestrian Insurance MARKET TO WITNESS ASTONISHING GROWTH

The report published on Equestrian Insurance is a valuable source of insightful statistics and information helpful for the decision-makers to form the business strategies related to products/services sales (value)and growth, key trends, technological advancement, untapped market, and more. The global Equestrian Insurance market report includes key facts and figures data which helps its users to understand the current scenario of the global market along with anticipated growth. The Equestrian Insurance market report contains quantitative data such as global sales and revenue (USD Million) market size/market value of different segments and sub-segments such as manufacturers, types, regions, uses, CAGR, market shares, revenue insights of market players, and others. The report also gives qualitative insights on the global Equestrian Insurance market, which gives the exact outlook of the global as well as country level Equestrian Insurance market.

Major Companies Profiled in the Global Equestrian Insurance Market are:

Markel Corporation, NFU Mutual, Philip Baker Insurance Services Inc, Philip Baker Insurance Services Inc, KBIS British Equestrian Insurance, Hare, Henry Equestrian Plan MGA, AXA SA, American Equine Insurance Group, China Pacific Insurance (Group) Co, Henry Equestrian Insurance Brokers Ltd, Wright Group Brokers Ltd, South Essex Insurance Brokers Ltd, Kay Cassell Equine Insurance, Kay Cassell Equine Insurance, Gow-Gates Insurance Brokers Pty Ltd, Chase & Heckman, Equine Group, County Insurance Services Limited, Madden Equine Insurance

Get an Exclusive Sample Report @ http://www.marketresearchstore.com/sample/global-equestrian-insurance-market-report-2020-industry-analysis-751181

Significant aspects of the Reports and Main Highlights:

• A detailed look at the Equestrian Insurance Industry

• Changing business trends in the global Equestrian Insurance market

• Detailed market bifurcation analysis at different level such as type, application, end-user, Regions/countries

• Historical and forecast the size of the Equestrian Insurance market in terms of Revenue (USD Million)

• Recent industry development and market trends

• Competitive Landscape and player positioning analysis for the Equestrian Insurance market

• Key Product Offerings by Major players and business strategies adopted

• Niche and Potential segments (ex. types, applications, and regions/countries) anticipated to observed promising growth

• Key challenges faced by operating players in the market space

• Analysis of major risks associated with the market operations

The focus of the global Equestrian Insurance market report is to define, categorized, identify the Equestrian Insurance market in terms of its segmentation for example by product, by types, by applications, and by end-users. This study also provides highlights on market trends, market dynamics (drivers, restraints, opportunities, challenges), which are impacting the growth of the Equestrian Insurance market. Driving factors that are positively impacting the demand and restraining factors that are hindering the growth of the Equestrian Insurance market are discussed in detail along with their impacts on the global Equestrian Insurance market.

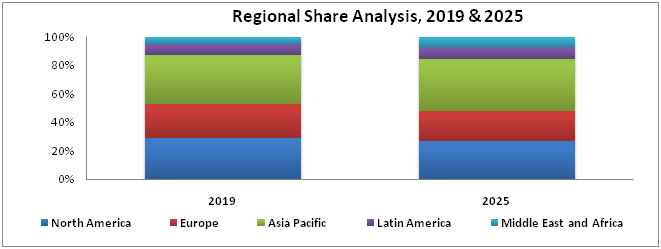

Some of the regions covers in the study are North America, Europe, Middle East & Africa, Latin America, and the Asia Pacific. These regions are further analyzed based on the major countries in it. Countries analyzed in the scope of the report are the U.S., Canada, Germany, the UK, France, Spain, Italy, China, India, Japan, South Korea, Southeast Asia countries, Australia, Brazil, Mexico, GCC countries, South Africa, and Turkey among others.

By Type the Equestrian Insurance market is segmented into:

Major Medical Insurance, Surgical Insurance, Full Mortality Insurance, Limited Mortality Insurance, Loss of Use Insurance, Personal Liability Insurance

By Application, the Equestrian Insurance market is segmented into:

Personal, Commercial

COVID-19 impact on the Equestrian Insurance market

The Equestrian Insurance market was moderately impacted by the COVID-19 pandemic. In the prevailing COVID-19 situation, the expected growth of the Equestrian Insurance market is expected to decline as the pandemic is restricting the supply of raw materials and other components due to severe disruptions in businesses and the global economy. The current situation has impacted the supply chain of Equestrian Insurance industry. Key components for Equestrian Insurance are mainly manufactured in Asia Pacific, North America, Europe, Rest of the World. The COVID-19 situation has exposed the over dependency on the region for key raw materials, especially China. Manufacturers in the Germany(Europe), US, India, and Australia are highly impacted by the shutdown of operations in China and other Asia Pacific countries. It has also resulted in limited production, leading to a serious decline in business inputs. The recovery depends on government assistance, as well as the level of corporate debt and how the companies and markets cope with the trimmed demand. After the recovery phase, the Equestrian Insurance market is projected to grow at a moderate rate until 2027.

To get customization on the report feel free to ask our experts: http://www.marketresearchstore.com/inquiry/global-equestrian-insurance-market-report-2020-industry-analysis-751181

Also, Read Our Trending Reports: